Remember, it is essential that your business, as well as the business of your client, is located in the European Union. Before an invoice is exempt from VAT, you must ensure that your client is a taxable person in another Member State.

If the final customer notifies its supplier of a VAT registration number in the member state of origin, the intra - community removal will become a deemed supply of own goods. I am VAT registered in the UK. I need to submit some invoices to a customer in France using the Chorus Pro portal. VAT on intra-community Supply?

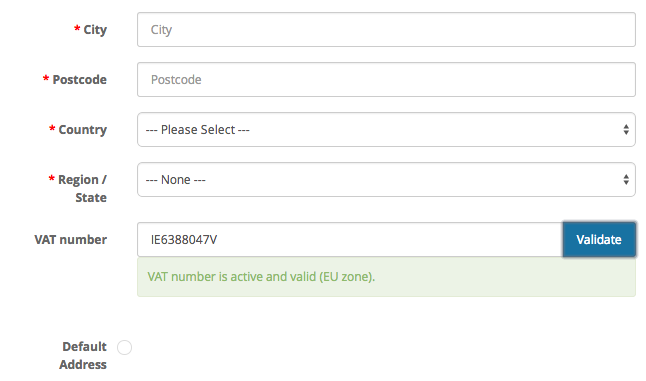

Benefit of VAT group? Different % of VAT? For further information see. It is important that companies take close care in using the correct format as the numbers are frequently checked against the VIES system, and errors may create delays or even fines.

These changes are not always reflected immediately in the national databases and consequently in VIES. This number is issued free of charge by the tax authority of each member country of the European Union. COMPOSITION OF AN INTRA - COMMUNITY VAT NUMBER.

Whilst the AG’s opinion is not binding, it does give serious weight to the position. This will be a set back for the German tax authorities which had been attempting to. VAT lookup is a Datalog service which enables you to verify vat numbers. VAT IDs, find vat numbers for a company and we then cross check the information against companies house and other company records.

Include sub-total, then VAT at 0. A margin scheme applies – a reference to the particular scheme involved ( e.g. ‘Margin scheme — travel agents’ ). VAT number search by company name. Every VAT identification number must begin with the code of the country concerned and followed by a block of digits or characters. Each EU country uses its own format of VAT identification number.

The EU Commission has been made aware that companies in different Member States have been receiving. When you sell goods or services to the clients in EU member states (so-calle intra - Community transactions), you can exclude VAT and move responsibility of paying VAT from yourself to your client, which is called reverse-charge procedure. Requirements for intra - Community transactions.

This sale is an intra - Community supply i. VAT for the Finnish business being the seller. The Belgian company, on the other han is making an intra - Community acquisition subject to VAT. VAT -Search has more than 6clients including By using VAT -Search.

All the countries in the EU are currently as follows with their two letter country codes: AT - Austria - characters always starting with a U. It must be considered as a final consumer who bears VAT. I called HMRC VAT helpline and they told me absolutely different things.

Because my earnings are. Missing trader fraud (also called missing trader intra - community or MTIC) and the related carousel fraud is the theft of Value Added Tax ( VAT ) from a government by organised crime gangs who exploit the way VAT is treated within multi-jurisdictional trading where the movement of goods between jurisdictions is VAT -free. Auteur du fil: Jane Perkins.

Intra - Community Acquisitions. Brexit preparedness remains a big concern for the UK ’s businesses. Perhaps the two areas that need most attention are customs formalities (importing and exporting goods or services), and intra - community VAT (invoicing businesses in other European Union member states). The VAT registration threshold for distance sale of goods to private individuals is GBP 7000.

Under the current VAT rules, a business may only exempt (zero-rate) an intra - community supply of goods where certain substantive conditions are met, such as the requirement for the goods to actually leave the member state of dispatch. The Court of Justice has ruled on a number of occasions that the requirement for the supplier to obtain and show the customer’s VAT registration number on the.

This is referred to as intra - Community acquisition.

Aucun commentaire:

Enregistrer un commentaire

Remarque : Seul un membre de ce blog est autorisé à enregistrer un commentaire.