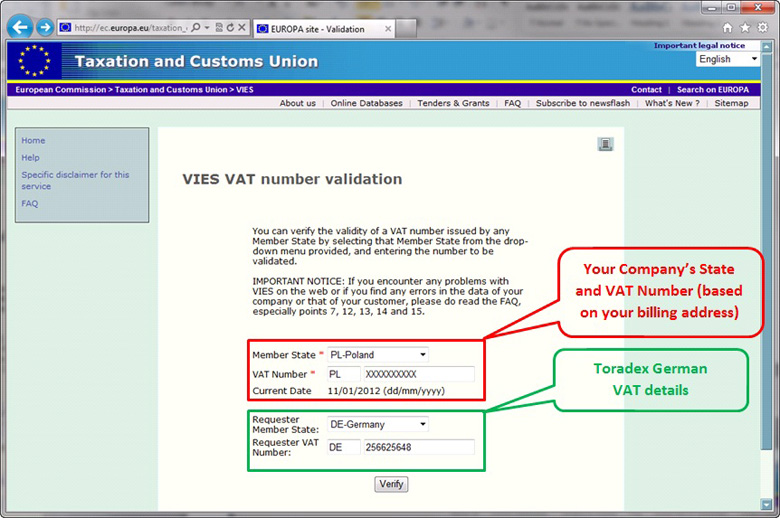

You can verify the validity of a VAT number issued by any Member State by selecting that Member State from the drop-down menu provide and entering the number to be validated. At Vatcheck you can check the VAT number of all European companies.

Validate your client’s VAT number with every sales transaction to a foreign company, this is important to ensure that you exempt the sale from VAT. If you grant customers exemption without having a valid VAT number, your company risks having to pay the exempt VAT and a fine. VIES ( VAT Information Exchange System) is a search engine (not a database) owned by the European Commission.

The data is retrieved from national VAT databases when a search is made from the VIES tool. National informationThe application of VAT is decided by national tax authorities but there are some standard EU rules, explained on this site. Please take into account that we are currently experiencing some issues with the verification against the Danish National VAT database. As a result, the validation of the Danish VAT numbers in VIES on the Web application cannot be guaranteed.

In case that you encounter such a situation, please re-submit your validation later. European VAT Check Service est un logiciel de Demo dans la catégorie Entreprise développé par WEST CONSULTING.

VAT lookup enables you to lookup and verify VAT numbers. You can also check VAT numbers by company name so you can find the vat registration number. We cross check this with the vast companies database on Datalog. We currently have VAT details of over 1. VAT -Search has more than 6clients including By using VAT -Search.

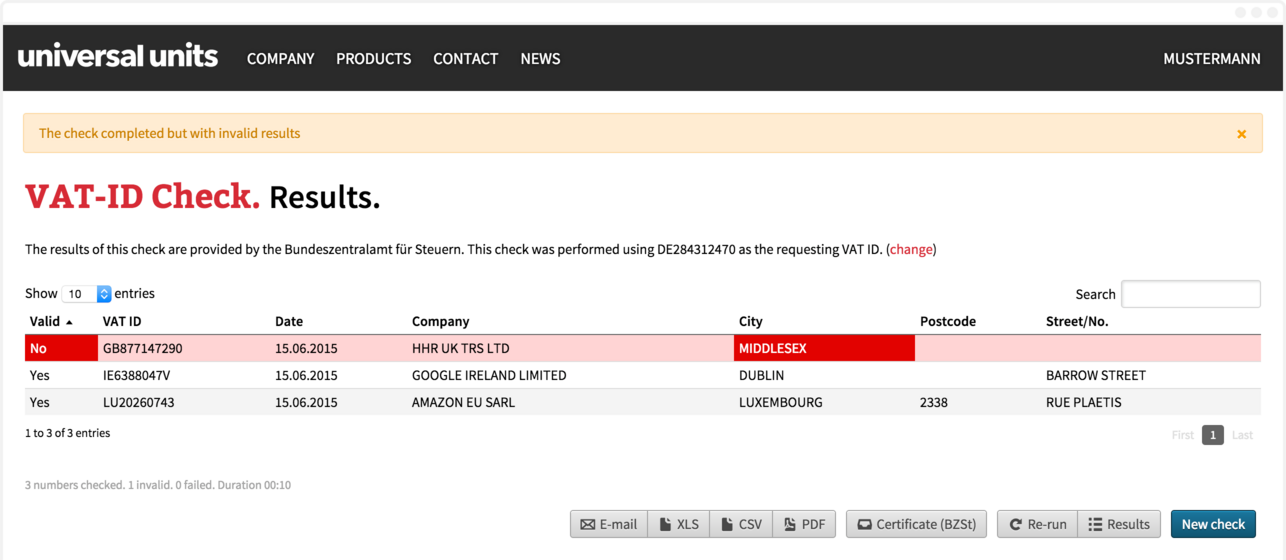

It can be used by both EU-based businesses and non-EU businesses. Notre antivirus a vérifié. Checks on the validity of a customer’s number should be made using the Europa website. When making an enquiry on the Europa website you must identify yourself by entering your own VAT registration number and print out a record of the date and time that the enquiry was made and the result of the enquiry.

If it later turns out that the customer’s number was invali you will be able to rely on the validation record as one element to demonstrate your good faith as a compliant business and. Although VAT is charged throughout the EU, each member country is responsible for setting its own rates.

You can consult the rates in the table below but to be sure you have the correct rate, it is recommended that you check the latest rates with your local VAT office. There are various types of VAT rates that are applied in EU countries. The rate depends on the product or service involved in the transaction. There are also special rates which were set according to VAT rates.

EUROPA – Sistem izmenjave podatkov o DDV (VIES): uporaba sistema. Search and check VAT number in all countries of European Union with our free service. Just enter country and VAT number. Chez Vatcheck vous pouvez contrôler le numérode TVA de toutes entreprises européennes.

Validez ici le numéro de TVA de votre client à chaque transaction de vente à une entreprise étrangère, ceci est important pour être certain que vous pouvez exonérer la vente de la TVA. The average VAT rate of the European countries covered is 21.

Most European countries set thresholds for their VATs. This means that a business’s revenue of taxable goods and services must be above a certain value before it is required to register and pay a VAT on its products. This registration threshold allows small businesses to save time and expenses in compliance.

However, it also discriminates against larger businesses, creating economic distortions. Check if the EU VAT number of a new customer or supplier is valid with our simple to use Avalara VAT registration verifier. Before conducting business with a new EU customer or supplier you should always verify their EU VAT number if they claim to be VAT registered.

VAT rules and rates: charging, deducting, exemptions and refunding. VAT special schemes for small businesses - Check VAT numbers within the EU (VIES). Obligatory information for VAT invoices.

Mini One-Stop-Shop (MOSS Scheme) - cross-border VAT rules. The EU sets the broad VAT rules through European VAT Directives, and has set the minimum standard VAT rate at 15%. The member states (plus UK) are otherwise free to set their standard VAT rates. The EU also permits a maximum of two reduced rates, the lowest of which must be 5% or above.

Some countries have variations on this, including a thir reduced VAT rate, which they had in place prior to their accession to the EU. Dieser Account wurde gesperrt!

Aucun commentaire:

Enregistrer un commentaire

Remarque : Seul un membre de ce blog est autorisé à enregistrer un commentaire.