However, the buyer then must pay the VAT in application in his country. Intra-Community supply involves exemption of VAT in the country of the seller. I-INTRA-COMMUNITY DELIVERIES : They are defined as the delivery of tangible goods shipped from one country to another country of the EEC. In the context of an external audit, the plaintiff could not provide unambiguous proof of the export of the goods to another EU Member State either by waybills or other records.

Below is a summary of the VAT system and the requirements in the triangular intra - community operations for the delivery of goods between persons or entities liable to pay VAT. It is important to note that we do not include here products subject to a specific tax regime (for example, products subject to excise duty). This VAT is known as acquisition tax and you can normally reclaim this if the acquisitions relate to VAT taxable supplies that you make.

The intra-Community supply and acquisition of goods occurs where goods are dispatched or transported between businesses in different Member States (MS) of the European Union (EU). For Value-Added Tax (VAT) purposes, two transactions are deemed to have occurred: intra-Community acquisition (ICA) intra-Community supply (ICS). The place of the intra-Community supply is where transport begins, that is to say in Malta.

Taxation and fiscal policies for the sharing. What is personal data?

De très nombreux exemples de phrases traduites contenant " intra - community vat number" – Dictionnaire français-anglais et moteur de recherche de traductions françaises. The plaintiff filed an action against the subsequent tax assessments on the grounds that the transport of the goods could be proved by witnesses.

The tax court and the BFH did not follow suit. The Value Added Tax Implementation. The intra - Community supply and acquisition of goods occurs where goods are dispatched or transported between businesses in different Member States (MS) of the European Union (EU).

When VAT taxpayers in different countries within the EU buy and sell goods with one another, it is “intra-Community trading”. The selling, known as “intra-community supply” (selling goods to a VAT-registered business in another EU country) is normally exempted from VAT.

An intra - Community acquisition is involved if you purchase goods that are transported from another EU country to the Netherlands whereby the supplier is an entrepreneur. The supply is taxed at 0% in the other EU country.

The purchased goods are taxed in the Netherlands with Dutch VAT. VAT on intra - Community trade is collected in the same way as domestic VAT, which means you need to contact your tax service for information. The Intrastat Declaration for trade in goods (DEB) Each month, you are required to fill out the Intrastat declaration (DEB) covering your intra - Community trade in goods with other Member States of the European Union and file it with customs.

Currently, the exemption of VAT on the intra-community delivery of goods is dependent on the goods being effectively transported to the territory of another Member State and on the purchaser being a businessperson, professional or legal person who has a VAT Identification Number in a Member State that is different from that of the sender. This aspect can be easily checked through the VIES list.

In the case of arrivals, it is in principle the person who – within the meaning of the VAT Law – pays taxes on an intra-Community acquisition that is obliged to submit information on that acquisition. Without this number, you will not be able to exercise your activity.

Community delivery that is obliged to provide related information for statistical purposes. Community supply of goods, the exporting undertaking must check whether the customer has to pay tax on the intra - Community acquisition in the country of destination.

The intra - community supply of goods between businesses is almost always zero-rated for VAT in the member state of origin and taxable as an acquisition by the customer in the destination member. An intra -EU supply of goods is a transaction in which goods are dispatched or transported by (or on behalf of) the supplier or the customer from one EU country to a destination in another EU country.

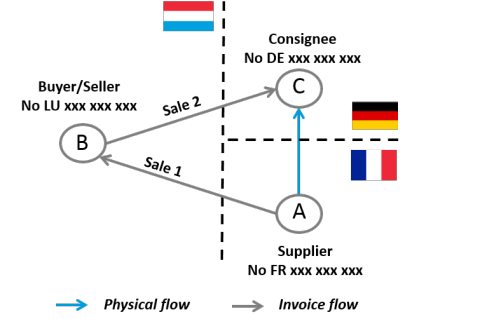

Currently, the exemption of VAT on the intra - community delivery of goods is dependent on the goods being effectively transported to the territory of another Member State and on the purchaser being a businessperson, professional or legal person who has a VAT Identification Number in a Member State that is different from that of the sender. New regulations regarding intra - Community chain transactions Intra - Community chain transactions.

One of the amendments is expected to simplify the treatment of chain transactions for VAT. Expert support when you need it. Whether you are receiving or supplying goods within the EU, we recommend that you undertake a regular professional review of your processes and documents.

This will ensure that nothing has been missed and that your transactions are being conducted properly in full compliance with the law. In many cases, this is because VAT is collected in some other part of the chain.

So, for example, an intra -EU supply may be exempt but the corresponding intra -EU acquisition will be taxed. These exemptions with the right to deduct are of eight different kinds: Exemptions for intra -EU supplies.

Aucun commentaire:

Enregistrer un commentaire

Remarque : Seul un membre de ce blog est autorisé à enregistrer un commentaire.