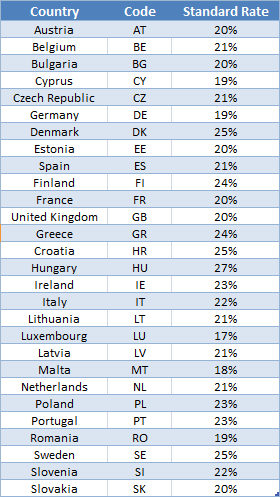

EU countries have flexibility about what VAT rates they implement, however the lowest standard rate that can be applied is %. VAT rates applied by EU countries - National VAT refund codes and features: MOSS database Updated by EU countries. National rules applied in Member States for the use of the mini one-stop shop (MOSS) Taxes in Europe Updated regularly.

Finland: 24%: €40: France: 20%: €175. The EU sets the broad VAT rules through European VAT Directives, and has set the minimum standard VAT rate at %. The member states (plus UK) are otherwise free to set their standard VAT rates. The EU also permits a maximum of two reduced rates, the lowest of which must be 5% or above.

With a huge list that contains all European countries, the respective VAT rates and for which product categories they apply, we are sure that you can find the rates you are looking for. Denmark and Sweden had the highest rate of VAT on.

Although VAT is charged throughout the EU, each member country is responsible for setting its own rates. You can consult the rates in the table below but to be sure you have the correct rate, it is recommended that you check the latest rates with your local VAT office. Buying services from another EU country. VAT on the transaction as if you had sold the services yourself, at the applicable rate in your country (using the reverse charge procedure).

A comparison of tax rates by countries is difficult and somewhat subjective, as tax laws in most countries are extremely complex and the tax burden falls differently on different groups in each country and sub-national unit. The average rate in Europe is about 21%. This is universal VAT calculator for any European country.

On the month, harmonised prices fell by 0. Get up to date VAT news. A Reuters poll had predicted an unchanged reading. At Touchpoint Communications our European network of tax professionals works directly with us to ensure successful Amazon VAT registration and VAT report. VAT Rates by Country United Kingdom - 20% Standard Rate - All other taxable goods and services.

Standard VAT rates for WWTS territories This table provides an overview of statutory VAT rates. In instances where a territory has a consumption tax similar to a VAT, that tax rate is provided. See the territory summaries for more detailed information (e.g. exempt items, zero-rated items, items subject to a reduced rate, alternative schemes). KPMG’s indirect tax table provides a view of indirect tax rates around the world.

List of Countries by Corporate Tax Rate - provides a table with the latest tax rate figures for several countries including actual values, forecasts, statistics and historical data. Use our interactive Tax rates tool to compare tax rates by country or region. They do this by charging it to themselves as part of their VAT accounting.

With tax playing an important role in the response to the coronavirus (COVID-19) pandemic, the OECD has outlined a range of emergency tax measures governments could adopt to curb the economic fallout of the crisis, and has also developed a compilation of all tax policy measures taken by governments so far. Browse our in-depth guides covering corporate tax, indirect tax, personal taxes, transfer pricing and other tax matters in more than 1countries.

Each country will have its own list. Super reduced rates are not always stated. The EU gives freedom to the member states to set their standard VAT rates, but not lower than 15%. The lowest standard VAT rate throughout the EU is 17%.

Different VAT rates apply in different EU member states. They can range from 17% in Luxembourg to 27% in Hungary. The standard VAT rates vary across both Europe and Asia. In Asia, Armenia has the largest rate (20%), followed by Georgia, Azerbaijan and Turkey with 18%, while India has a 12.

Japan has the lowest rate, at 5%. Hungary has the highest rate of VAT, at percent. Each individual EU country sets its own specific rate of VAT. List of Countries by Sales Tax Rate - provides a table with the latest tax rate figures for several countries including actual values, forecasts, statistics and historical data.

By law, this rate only has to be higher than 15%, or 5% for specific goods and services which qualify for the reduced rate. You can find the individual rates for each country on that country ’s relevant tax authority website. With a real tax rate of 57. The European Commission site has links to each authority.

Sweden rounded up the top ten with a real tax rate of 47. Belgium was secon and Austria came in third. The consequences of getting this wrong can impact your customers too, as the VAT invoices you provide serve as evidence of their potential right to deduct or reclaim VAT. Cyprus ranked at the.

VAT invoices are not always strictly required according to European VAT law, however you are generally obliged to provide a valid VAT invoice upon request.

Aucun commentaire:

Enregistrer un commentaire

Remarque : Seul un membre de ce blog est autorisé à enregistrer un commentaire.