Basic principles of the EU-wide rules. There are some exceptions to this rule. For example, if you provide a service to another business, that is not located in the same EU country as your company is base the VAT will not appear on your invoice. The Directive aims at reducing regulatory fragmentation, by.

For EU-based companies, VAT is chargeable on most sales and purchases of goods within the EU. In such cases, VAT is charged and due in the EU country where the goods are consumed by the final consumer. Likewise, VAT is charged on services at the time they are carried out in each EU country.

VAT invoices are not always strictly required according to European VAT law, however you are generally obliged to provide a valid VAT invoice upon request. Taxation and fiscal policies for the sharing. What is personal data? If the same product is sold to the final consumer within the EU, you may need to charge VAT at the rate applicable in their country.

Find out more about the rules that affect you by using the options below. The EU has standard rules on VAT, but these rules may be applied differently in each EU country. In most cases, you have to pay VAT on all goods and services at all stages of the supply chain including the sale to the final consumer.

EU ’s e- invoicing rules raise concerns. This is generally around €200. New study exploring the evolving European VAT landscape highlights the challenges faced by the tax frontline within Europe.

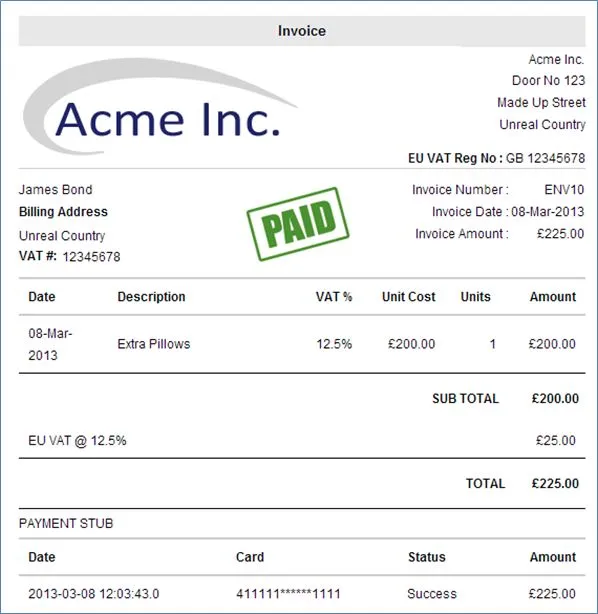

Date published February202. To help underpin the workings of the European Union Single Market and VAT regime, the EU sets the minimum disclosure requirements for VAT invoices.

The amended UK rules require the invoice to be issued by the 15th day of the month following that in which the goods are removed or the services performed. If you supply services to a business customer in the EU, you don’t need to charge VAT - the customer is responsible for paying VAT in their country.

Only VAT -registered businesses can issue VAT invoices and you must: issue and keep valid invoices - these can be paper or electronic keep copies of all the sales invoices you issue even if you. The measure will be of significant practical benefit to firms operating within the Internal Market because it will ensure that they have only to deal with a single, simplified set of rules on invoicing valid throughout the EU instead of fifteen different sets of legislation. At the same time, the.

The changes will, in some cases, reduce the timescale for UK businesses to issue a VAT invoice. The rules for time limits for issuing a VAT invoice have been aligned within the EU. VAT invoicing rules are coherent with other EU policies, both legislative acts and other initiatives. The VAT rules that apply to issuing of e-invoices (electronic invoices) in the European Union vary from country to country.

Furthermore, the rules keep on changing on a continues basis. In some countries there are no prescribed standards in addition to the requirements that are in place for the standard "paper invoices". Examples of countries applying no special rules are Finlan Sweden and the Netherlands.

In other countries, the procedures are much more complex, and a so called "qualified. A list of EU VAT contacts can be found in Notice 725.

If the place of supply of your service is not in the EU, you do not have to charge EU VAT but you should include the sale in box on your VAT. In accordance with the principle.

It also creates an EU legal framework for electronic transmission and storage of invoices. French VAT obligations for the layout and disclosures to be made on invoices conforms with the EU VAT Directive and its VAT invoice requirements. In the EU most goods have VAT added to the price in the country where they’re purchased. However, if you plan to bring a new land vehicle, boat or aircraft into the UK from an EU country and it is.

Invoices must be stored for six years. The UK VAT rate will no longer apply, and the relevant VAT rate for your country will be applied. Financial Times will collect VAT from FT. The European Commission has launched an evaluation of the invoicing rules laid down in the VAT Directive.

While the EU intends to modernize and simplify the VAT system for online sales of goods, the new rules also aim to raise VAT revenues and combat VAT fraud. These changes will have a significant impact on e-commerce businesses. We would like to guide you through the complexities and implementation, for you to get your data, systems and processes ready in time.

The supplier must include the phrase, "Steuerschuldnerschaft des Leistungsempfängers" where the recipient pays VAT under the reverse charge mechanism. If no VAT is applie exempt or reverse charge notes must be provided.

Aucun commentaire:

Enregistrer un commentaire

Remarque : Seul un membre de ce blog est autorisé à enregistrer un commentaire.