Taxation and fiscal policies for the sharing. What is personal data? However, if those services are provided to. This Directive establishes the common system of value added tax ( VAT ). The principle of the.

Web will request a valid VAT number in one of the EU member states in order not to invoice the VAT to the Business customer. If such VAT number is not provided or is invali iWeb will invoice the VAT.

Le prestataire étant établi en Autriche, il facturera la TVA autrichienne à son client. In the absence of such place of establishment or fixed establishment, the place of. When selling outside the EU, no tax. Ange också köparens VAT-nummer (moms-nummer) på fakturan Många företagare sliter sitt hår i förtvivlan över denna maximering av administrationen som EU älskar att slänga över företagen.

Pour les services qui ne sont pas de ceux qui sont communément utilisés dans le. As a consequence thereof, VAT becomes due in that country. Some member states have however adopted diverging and confusing administrative positions, which usually aim at considering that the services in respect to admission to events are subject to the default B2B rule ( article of the EU VAT directive ) under specific circumstances.

TITLE II TERRITORIAL SCOPE. En outre, dans cette hypothèse, vous devez réaliser une déclaration d’échange de services. Vienti EU : n ulkopuolelle. Teksti ei ole pakollinen tavaroiden ja palveluiden viennille, mutta tässä on oikeudelliset ohjeet viittaukselle, jos haluat olla johdonmukainen laskutuksen kanssa.

Palvelujen myynti: No VAT applied. Tuotteiden myynti: No VAT applied. Ici viendront les guidelines. L’ article a pour objet d’énoncer le princip.

Pour conclure sur les mentions factures internationales. To ensure that the tax is neutral in impact, irrespective of the number of transactions, taxable persons for VAT may deduct from their VAT account the amount of the tax which they have paid to other taxable persons. VAT is finally borne by the final consumer in the form of a percentage addition to the final price of the goods or services.

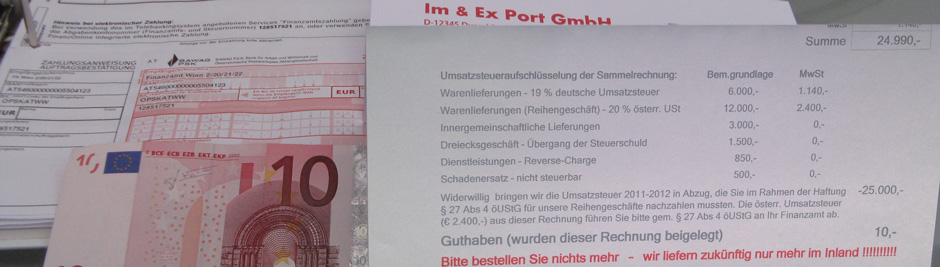

At the Economic and Financial Affairs Council meeting, EU finance ministers discussed the proposal for a Council directive concerning the generalised VAT reverse charge mechanism. In such a business model, excess VAT therefore inevitably arises for the exporter.

If your company makes taxable supplies of goods or services below a certain annual limit, it may be exempt from VAT. In most EU countries you can apply for a special scheme that enables you to trade under certain conditions without the need to charge VAT. You may — if you choose — voluntarily opt for the normal VAT arrangements, in which case you.

Input VAT that is attributable to exempt supplies is not recoverable. In case the customer is a private individual, B2C rules locate the transaction where the supplier is located. Buying services from another EU country. VAT on the transaction as if you had sold the services yourself, at the applicable rate in your country (using the reverse charge procedure).

VAT Directive ’) and supporting regulations. If you sell goods to customers outside the EU, you do not charge VAT. Selling services to customers outside the EU. If you provide services to customers outside the EU, you usually do not charge VAT.

VAT shall be payable by any taxable person, or non-taxable legal person identified for VAT purposes, to whom the services referred to in Article are supplie if the services are supplied by a. Member States may release taxable persons from the obligation laid down in Article 220(1) or in Article 220a to issue an invoice in respect of supplies of goods or services which they have made in their territory and which are exempt, with or without deductibility of the VAT paid in the preceding stage, pursuant to Articles 1and 11 Article 125(1), Article 12 Article 128(1), Article 132. This makes supplies liable to tax.

Aucun commentaire:

Enregistrer un commentaire

Remarque : Seul un membre de ce blog est autorisé à enregistrer un commentaire.